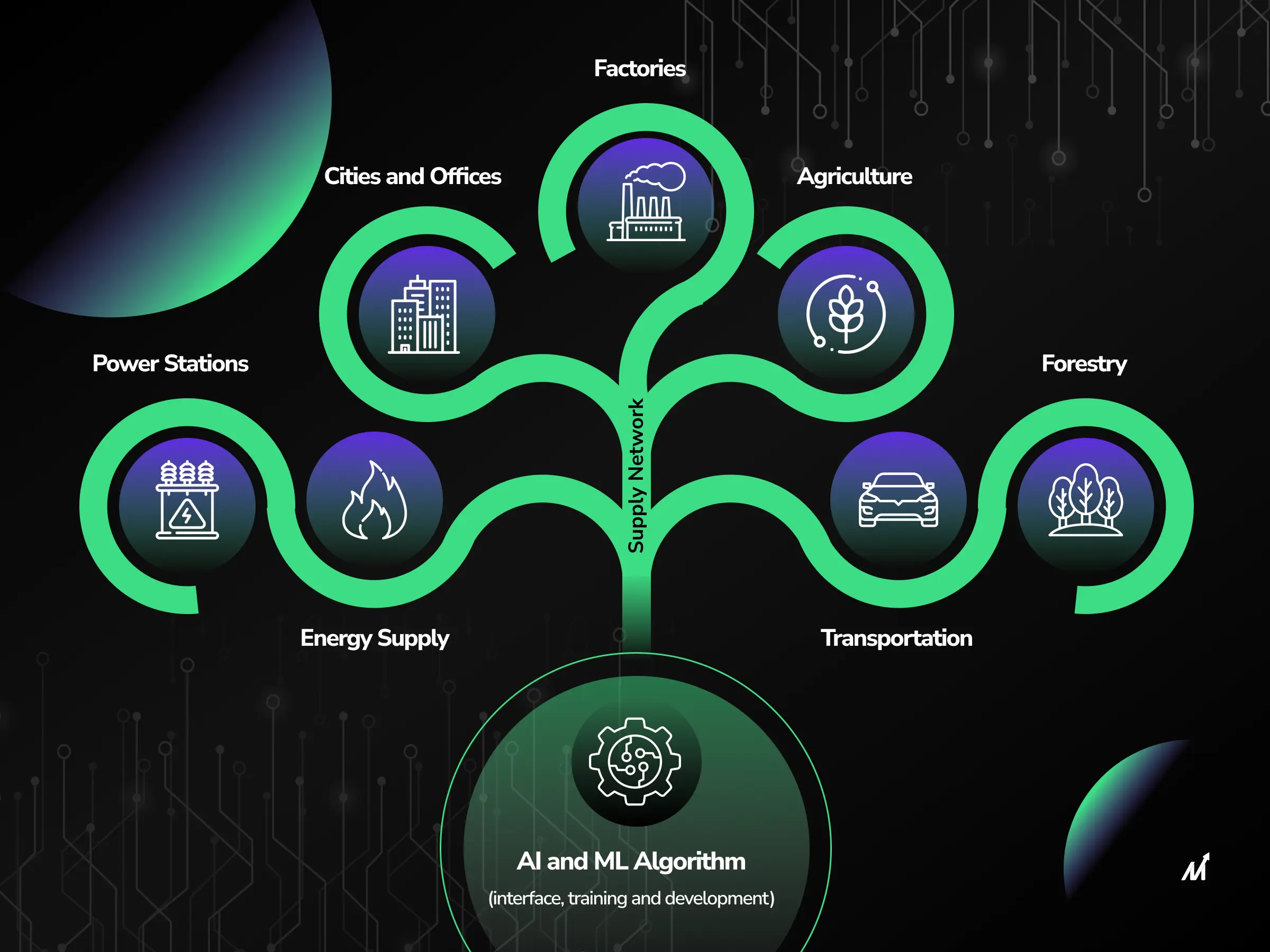

In the realm of Swift Alliance, there exists a diverse range of interfaces that cater to different needs and functionalities. These interfaces play a crucial role in facilitating seamless communication and transactions within the Swift network. By delving into the various types of interfaces present in Swift Alliance, we can gain a deeper understanding of their unique features and capabilities. In this article, we will explore the different types of interfaces such as Alliance Access, Alliance Lite, Alliance Gateway, Alliance Cloud, Alliance Lite2, Alliance Messaging Hub, and Swift Integration Layer. By the end of this read, you will have a comprehensive knowledge of the diverse interfaces that contribute to the efficiency and effectiveness of Swift Alliance.

Exploring Swift Alliance Interfaces

Overview of Swift Alliance’s Role in Financial Communication

Swift Alliance interfaces, such as Alliance Access and Alliance Lite, are essential components of financial communication within the industry. These interfaces serve as the primary messaging platforms used by Swift customers to securely transfer messages and files to correspondents and market infrastructures. By validating messages against Swift Standards, storing them in local databases, and securely routing them via the Alliance Gateway, these interfaces ensure efficient communication and adherence to industry regulations. The evolution of Swift Alliance interfaces highlights the adaptability of Swift to meet the changing technological landscape and the diverse needs of financial institutions.

The Evolution of Swift Alliance Interfaces

The evolution of Swift Alliance interfaces signifies Swift’s commitment to innovation and addressing the evolving demands of the financial sector. Various interface options, such as Alliance Access, Alliance Lite, and personalized Swift interfaces, are tailored to provide secure and reliable messaging solutions for customers. The development of personalized Swift interfaces reflects Swift’s acknowledgment of the varying requirements of users, allowing for customized solutions to enhance communication and operational efficiency.

Alliance Gateway and Security

- Alliance Gateway serves as the default traffic gateway, consolidating all Swift traffic and providing a secure connection to authorized correspondents.

- Emphasis on security underscores Swift’s dedication to maintaining a robust messaging infrastructure for financial institutions worldwide.

SWIFTNet System Access

- Alliance Access is a prominent interface catering to users with high transaction volumes and specific requirements.

- Evolution towards cloud-based solutions like Alliance Cloud and Alliance Lite2 offers scalability, flexibility, and ease of access.

- Alliance Messaging Hub (AMH) and SWIFT Integration Layer (SIL) provide users with customizable messaging solutions and technical connectivity to SWIFT interfaces.

Role in Financial Communication

- SWIFT Alliance interfaces play a crucial role in enabling secure access and constant technical updates for efficient financial communication.

- SWIFT Service Bureaus offer certified access to SWIFT products for banks and companies, enhancing connectivity and service offerings.

- Alliance Lite2 for Business Applications (L2BA) facilitates fully automated processes with Straight Through Processing (STP) capabilities, reflecting the industry’s move towards modern communication solutions.

Overall, the comprehensive overview of Swift Alliance interfaces underscores their significance in facilitating secure and efficient financial messaging for international banks and companies, showcasing Swift’s continuous commitment to innovation and meeting the dynamic needs of the financial industry.

Alliance Access is a comprehensive gateway provided by SWIFT, offering a secure messaging interface for financial institutions to transfer messages and files securely. It serves as a market-preferred solution for Swift customers, facilitating communication with correspondents and market infrastructures.

Key Features and Capabilities

Alliance Access offers key features such as message validation against Swift Standards, local message storage, and secure message routing via the Alliance Gateway. It also supports InterAct and FileAct through MQ, SOAP, and File adapters, providing a versatile solution for financial institutions to streamline their messaging processes.

Ideal Use Cases for Financial Institutions

Financial institutions can leverage Alliance Access for connecting corporates, investment managers, and small banks to the Swift network. The platform offers Alliance Lite for lightweight integration and Alliance Gateway for secure communication. Institutions can develop custom Swift interfaces for FIN, FileAct, and/or InterAct to meet specific business requirements.

Benefits for Financial Institutions:

- Enhanced operational efficiency

- Customized messaging solutions

- Streamlined messaging processes

Integration with Banking Systems

Integration with banking systems is crucial for seamless communication and data exchange. Alliance Access offers integration options such as Alliance Messaging Hub (AMH), SwiftNet Link, and Swift APIs, enabling efficient message transmission while complying with industry regulations.

Integration Capabilities:

- SWIFT Integration Layer (SIL)

- Communication in various message formats

- Efficient data exchange through files or IBM WebSphere MQ

Overall, Alliance Access is highlighted as a key solution among SWIFT gateways, offering comprehensive access to SWIFT functions and ensuring reliable management of financial messages globally. Its integration capabilities with banking systems enhance connectivity and streamline operations for financial institutions, making it a trusted gateway for their operations.

Alliance Cloud: Simplifying Connectivity

Swift Alliance offers a variety of interfaces and integration options to simplify connectivity for financial institutions. These interfaces, including Alliance Access and Alliance Lite, provide secure messaging services and support for financial transactions, ensuring compliance with industry standards and regulations.

Benefits of Cloud-Based Solutions

Cloud-based solutions offer numerous benefits in the financial industry, particularly in terms of security measures and compliance. Alliance Cloud provides a comprehensive suite of services to help institutions transact securely, comply with regulations, improve operational efficiency, and innovate at scale. By leveraging cloud technology, institutions can enhance their data and technology capabilities, streamline operations, and reduce costs.

- Enhanced data and technology capabilities

- Streamlined operations

- Cost reduction

Security Measures and Compliance

Alliance Cloud emphasizes data-driven compliance and business intelligence to stay ahead of regulatory demands and competition in the market. It ensures secure transmission of financial messages globally and adheres to constant technical changes to maintain the security of SWIFT interfaces.

- Constant technical updates for secure transmission

- Adherence to compliance standards

- Enhanced security measures

Connecting to Swift through a Managed Service

Alliance Cloud provides a range of services, such as Alliance Messaging Hub and Swift APIs, to facilitate seamless integration with Swift for financial messaging. Managed services like Alliance Lite2 for Business Applications enable fully automated processes, enhancing connectivity and operational efficiency for users.

- Fully automated processes for efficient operations

- Individualized solutions for tailored connectivity

- Technical bridges for seamless integration

Alliance Lite2: Swift’s Lightweight Interface

Advantages of Alliance Lite2

Alliance Lite2 offers numerous advantages for corporates, investment managers, and small banks seeking to connect to the Swift network. One of its key benefits is the ease of setup and use, making it a user-friendly solution for secure and efficient communication with authorized Swift correspondents. The light and simple file-based interface of Lite2 simplifies the integration process, making it an ideal choice for businesses looking for a streamlined and cost-effective way to access Swift’s messaging services. Additionally, Alliance Lite2 is tailored to meet the specific messaging requirements of its target users, providing a customized solution that enhances their overall experience.

Understanding the Setup Process

Setting up Alliance Lite2 is a straightforward process that can be easily accomplished by following the provided guidelines. The cloud-based interface allows users to access the Swift network from any internet-enabled computer using a web-based GUI, ensuring convenience and flexibility in managing transactions and file transfers. Encryption via a USB token enhances security measures, while the user and rights management feature enables larger companies to organize their work processes efficiently. Moreover, the L2BA feature supports fully automated processes, enabling seamless communication without human intervention and streamlining workflows for increased efficiency.

Comparing Lite2 with Other Interfaces

When comparing Alliance Lite2 with other Swift interfaces like Alliance Access and Alliance Cloud, it stands out for its simplicity and user-friendly features. While Alliance Access offers comprehensive customization options and Alliance Cloud provides scalability through cloud technology, Lite2 excels in its lightweight design and ease of use. The interface’s focus on simplicity and efficiency makes it a preferred choice for users prioritizing streamlined financial messaging operations. Overall, Alliance Lite2 serves as a reliable and secure gateway to the Swift network, catering to the diverse needs of banks and companies worldwide.

Alliance Lite2 for Business Applications (L2BA)

Extending Functionality with L2BA

Alliance Lite2 for Business Applications (L2BA) offers a comprehensive range of solutions that connect back-office systems to Swift, enabling the seamless sending and receiving of financial messages. This software allows for easy integration with Swift APIs, Alliance Cloud, Virtual Alliance Lite2, Alliance Access, and Alliance Messaging Hub, providing businesses with the tools they need to streamline their financial messaging operations and enhance overall functionality. By leveraging L2BA, organizations can improve operational efficiency, compliance, and innovation at scale to better serve their customers in the financial industry.

Integration with Business Applications

Integration with Business Applications is a key feature of Alliance Lite2 for Business Applications (L2BA), allowing for the development of custom Swift interfaces for FIN, FileAct, and/or InterAct. This integration capability enables businesses to tailor their Swift interface to meet specific needs and requirements, while also providing the flexibility to develop and qualify their own interface vendors before market release. With Alliance Lite2, organizations can seamlessly integrate their business applications with Swift, ensuring secure and reliable communication with authorized Swift correspondents through the Alliance Gateway and SwiftNet Link software, supported by PKI security measures.

Use Cases and Implementation Scenarios

Use Cases and Implementation Scenarios of Alliance Lite2 for Business Applications (L2BA) showcase its versatility and adaptability for various industries and organizations. This cloud-based access to the SWIFT network offers a user-friendly interface for secure and efficient communication between software programs, enabling Straight Through Processing (STP) operations for fully automated processes. With features such as encryption via a USB token and user and rights management, L2BA is a valuable tool for larger companies looking to organize work processes securely and effectively.

Alliance Messaging Hub (AMH): Streamlining Operations

The Alliance Messaging Hub (AMH) is a powerful platform that plays a crucial role in streamlining operations within the financial industry. It offers a wide range of features and functionalities that enhance messaging efficiency, customization, and scalability.

Exploring the Features of AMH

AMH provides users with a highly customizable solution, often referred to as a “Lego solution.” This means that users can select and integrate specific modules that best suit their individual needs, allowing for flexibility and control over messaging operations. The platform includes a monitoring system and a process engine with a graphical user interface, facilitating efficient management of financial messages on a global scale.

How AMH Enhances Messaging Efficiency

One of the key strengths of AMH is its ability to enhance messaging efficiency. By offering users the option to create tailored solutions that align with their specific requirements, AMH enables organizations to streamline their operations effectively. The platform’s monitoring system and process engine empower users to access all SWIFT functions seamlessly, ensuring a smooth and efficient messaging process.

Customization and Scalability Options

AMH stands out for its robust customization and scalability options, making it an ideal solution for international banks and companies with diverse messaging needs. The platform allows users with high transaction volumes to manage their messaging processes effectively by tailoring the solution to their unique requirements. This level of customization and scalability ensures that organizations can optimize their messaging efficiency and enhance operational capabilities to meet evolving business demands.

Benefits of AMH:

- Improved operational efficiency

- Enhanced messaging processes

- Greater customization and scalability

- Seamless integration with existing systems

- Support for future growth and expansion

In conclusion, the Alliance Messaging Hub (AMH) plays a significant role in shaping the future of finance by providing a comprehensive and efficient messaging solution for financial institutions. By leveraging the platform’s features, organizations can achieve operational excellence, enhance messaging efficiency, and adapt to changing business needs effectively.

Swift Integration Layer (SIL): The Next Step in Integration

Understanding SIL’s Role in Swift Alliance

The Swift Integration Layer (SIL) acts as a vital bridge between the user’s IT system and various Swift Alliance interfaces such as Alliance Access, Cloud, or AMH. It facilitates seamless communication by supporting multiple message formats like SWIFT MT MX and connecting with all messaging services. This integration layer plays a key role in enhancing the efficiency and reliability of interface management for users with diverse requirements.

Benefits of Using SIL for Interface Management

SIL offers numerous benefits for organizations looking to streamline their interface management processes. It enables secure and efficient data exchange with Swift interfaces, ensuring smooth connectivity and communication. By simplifying the integration process and providing a technical bridge between the user’s IT system and Swift interfaces, SIL enhances the overall user experience while maintaining data security and compliance.

Key Benefits of SIL:

- Support for various message formats and services

- Flexible and reliable communication channel

- Enhanced efficiency and effectiveness of interface management

Technical Insights and Configuration

Technical insights into SIL reveal the customization options available for developing custom Swift interfaces for FIN, FileAct, and InterAct. This highlights the flexibility and adaptability of SIL in meeting specific business requirements. By leveraging SIL, users can enhance operational efficiency, ensure regulatory compliance, and improve communication with their counterparts in the financial industry.

Overall, SIL plays a crucial role in shaping the future of financial messaging services by providing comprehensive integration solutions that connect back-office systems to Swift. It emphasizes the importance of technology and innovation in streamlining operations, enhancing security, and driving efficiency in message transmission and processing. With SIL, organizations can stay ahead of the curve in integration practices and harness the power of Swift Alliance for success in the evolving landscape of financial services.

When it comes to accessing the SWIFTNet system, financial institutions and businesses have a range of interface options to choose from. These interfaces play a crucial role in facilitating secure and efficient financial messaging. Let’s delve into a comparative analysis of Swift Alliance Interfaces to help you understand how to select the right interface for your specific needs.

Choosing the Right Interface for Your Needs

It is essential to consider your organization’s requirements and transaction volumes when selecting a Swift Alliance Interface. The available options, such as Alliance Access, Alliance Lite, Alliance Gateway, and custom Swift Interfaces, cater to different needs.

Performance and Reliability Across Interfaces

Performance and reliability are key factors to consider when choosing a Swift Alliance Interface. Alliance Gateway serves as the default traffic gateway, ensuring secure connections and concentrating Swift traffic. The Swift Communication interface, SwiftNet Link, and PKI security contribute to a secure message transfer experience. Custom Swift Interfaces offer flexibility and customization options for businesses seeking to enhance their financial messaging capabilities.

Cost Considerations and Investment

Cost considerations and investment play a significant role in the decision-making process for selecting a Swift Alliance Interface. Interface vendors invest in developing and marketing interfaces, emphasizing the importance of evaluating the long-term benefits and return on investment. Options like Alliance Lite AutoClient cater to specific applications and offer a file-based interface for efficient financial messaging.

Additional Considerations:

- The SWIFT Service Bureau provides a shared IT environment for accessing SWIFT products and services.

- Alliance Access is recommended for high transaction volumes and specific requirements.

- Alliance Cloud and Alliance Lite2 offer scalability and flexibility for different needs.

- The SWIFT Integration Layer bridges the gap between IT systems and SWIFT interfaces.

By considering the factors of performance, reliability, cost, and investment, you can make an informed decision when selecting a Swift Alliance Interface that best suits your organization’s requirements and goals.

Innovations on the horizon in Swift Alliance Interfaces are expected to revolutionize the way financial messages are transferred and processed. With the rapid advancement of technologies such as Distributed Ledger Technology (DLT) and cloud computing, organizations will need to embrace these changes to stay competitive. The data emphasizes the need for continuous collaboration and partnership through the Swift Partner Programme to build the future of finance together. By joining forces with other industry professionals, organizations can leverage their expertise and resources to drive innovation and shape the future of financial messaging services.

The Impact of Emerging Technologies

Preparing for future changes in Swift interfaces requires a strategic approach to navigate the complexities of the financial industry. Organizations must focus on enhancing operational efficiency, complying with regulations, and improving customer service. By investing in training, consulting, and support services offered by Swift, organizations can build their in-house expertise and effectively implement new technologies. Additionally, leveraging Swift’s comprehensive range of solutions for interfaces and integration can streamline operations and ensure seamless connectivity with back-office systems. Overall, staying proactive and adaptable to future changes will be key to success in the evolving landscape of Swift Alliance Interfaces.

Preparing for Future Changes in Swift Interfaces

The data provided discusses the future trends in Swift Alliance Interfaces, focusing on innovations on the horizon, the impact of emerging technologies, and preparing for future changes in Swift interfaces. It highlights the various SWIFT interfaces available, such as Alliance Access, Alliance Cloud, Alliance Lite2, L2BA, AMH, and SIL, each catering to different user requirements and offering unique features. The article emphasizes the importance of secure access to the system and the constant technical changes that SWIFT interfaces undergo to meet evolving customer needs and industry standards. It also mentions how service providers differentiate themselves through consulting, training, and service offerings, showcasing the competitive landscape within the SWIFT network.

conclusion

In conclusion, Swift Alliance offers a diverse range of interfaces such as Alliance Access, Alliance Cloud, Alliance Lite2, L2BA, AMH, and SIL, each playing a crucial role in streamlining financial communication processes for banks and corporations worldwide. These interfaces provide secure, efficient, and user-friendly solutions for transferring messages and files, ensuring compliance and enhancing connectivity within the industry. As technology continues to evolve, future trends in Swift Alliance Interfaces are expected to bring about innovative changes in the way financial messages are transmitted and processed, driving efficiency and shaping the future of financial messaging services. It is imperative for organizations to carefully assess their needs and transaction volumes when selecting a Swift Alliance Interface, ensuring seamless integration and optimal performance in their financial operations. Overall, Swift Alliance interfaces underscore Swift’s commitment to innovation and meeting the dynamic needs of the financial industry, solidifying its position as a leader in financial communication solutions.