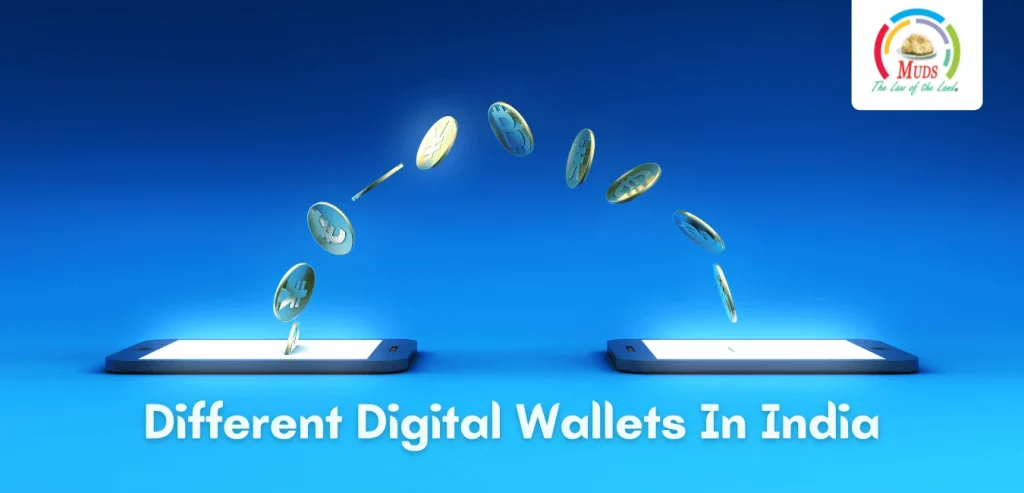

In India, the Reserve Bank of India (RBI) has established guidelines and regulations for digital wallets, ensuring that they operate under financial regulation. These guidelines cover three types of digital wallets that have obtained permission from the RBI. The first type is closed loop wallets, which are designed for specific purposes and can only be used within the company’s online platform. The second type is semi-closed (open) wallets, which can be topped up from a bank account and used for purchases but not for ATM withdrawals. The third type is open wallets, such as PayTM, which can be loaded from various sources and used like a bank account. All of these digital wallets require RBI approval and must adhere to RBI KYC norms. This article aims to explore the different types of digital wallets in India that have obtained permission from the RBI and the regulations that govern their operations.

Understanding the Regulatory Framework for Digital Wallets in India

In understanding the regulatory framework for digital wallets in India, it is crucial to recognize the role of the Reserve Bank of India (RBI) in the regulation of digital payments. The RBI has established guidelines and regulations regarding the use of digital wallets, including those used for application transactions. This means that any application wallet used for financial transactions, storing digital cash, or facilitating payments must adhere to the RBI’s regulations and may require RBI approval.

The role of RBI in digital payment regulation

The RBI plays a significant role in overseeing and regulating digital wallets in India, ensuring adherence to established norms and compliance levels.

Mandatory RBI approval and adherence to KYC norms

The mandatory RBI approval and adherence to KYC norms are essential aspects of operating digital wallets in India. The RBI approval is linked to wallets because they are used for financial transactions, digital cash storage, and various other monetary operations. It is important to note that different types of wallets, such as closed loop, semi-closed (open) wallet/network, and open wallet, each have specific requirements for RBI approval and adherence to KYC norms.

Types of Wallet Operations:

- Closed loop wallets may circulate funds within wallet owners for specific purposes.

- Semi-closed wallets allow for top-up from bank accounts and purchase from merchants but do not permit ATM withdrawals.

- Open wallets function similarly to bank accounts and are subject to the same compliance levels as semi-closed wallets.

Obtaining RBI approval and adhering to KYC norms are integral components of the regulatory framework for digital wallets in India, ensuring transparency and compliance with established regulations.

Delineating Closed System Payment Wallets

Obtaining a payment wallet license or prepaid wallet license in India is a regulated process overseen by the Reserve Bank of India (RBI). Payment wallet instruments can take various forms, such as debit cards, credit cards, mobile accounts, and paper vouchers. These instruments are categorized into closed system, semi-closed system, and open system payment wallets, each with its own set of advantages and limitations.

Characteristics of closed loop wallets

Closed loop wallets are designed to allow money to circulate within the wallet owners as dummy cash denominations or rewards points. These funds cannot be transferred to a bank account or redeemed as cash, distinguishing closed loop wallets from semi-closed and open wallets. RBI approval is crucial for closed system payment wallets due to their use for financial transactions and storing digital cash.

Usage within specific online platforms

Specific online platforms utilize closed system payment wallets for tailored purposes. For example, iBIBO/NetMed NMS Wallet is used exclusively for purchasing medicine from the NetMed portal and cannot be used for other purposes. Understanding the usage within specific online platforms is essential for businesses and individuals seeking to integrate closed system payment wallets within their operations.

Examples of closed system payment wallets

Examples of closed system payment wallets include PayTM, which operates as an open wallet allowing money to be loaded from various sources, including net banking, cards, and UPI. These examples showcase the diversity within closed system payment wallets and how they cater to different user needs and preferences. Real-world illustrations of how these wallets function and are utilized within the digital ecosystem provide valuable references for anyone seeking to explore or implement closed system payment wallets.

Types of Digital Wallets in India with RBI Permission

Exploring Semi-closed Payment Wallets

How semi-closed wallets function

Semi-closed payment wallets are an important aspect of the digital payment ecosystem in India, and understanding how they function is crucial for both users and providers. These wallets operate on a semi-closed network, meaning that they can be topped up with cash from a bank account and used for purchases from merchants, but do not allow for ATM withdrawals or other forms of redemption. This distinction is important as it affects the regulatory requirements and usage limitations for such wallets. Additionally, the identified merchant networks for redemption play a significant role in determining the usability and acceptance of semi-closed wallets, making it essential for providers to establish partnerships with a wide range of merchants to ensure the convenience and accessibility of their services.

Top-up methods and usage limitations

Furthermore, the process of obtaining RBI approval for semi-closed wallet operations is a crucial aspect that providers need to navigate. This approval is necessary due to the financial nature of these wallets, as they are used for storing digital cash and facilitating financial transactions. Providers must adhere to RBI guidelines and regulations to ensure compliance with KYC norms and other regulatory requirements. Understanding the top-up methods and usage limitations of semi-closed wallets is also essential for users, as it impacts how they can load funds into their wallets and the restrictions on their usage.

Identified merchant networks for redemption

In the context of India, there are prominent semi-closed wallet providers that play a significant role in shaping the digital payment landscape. Providers like PayTM and DBS Internet bank account offer open wallets that allow for loading funds from various sources such as net banking, cards, and UPI, operating similarly to bank accounts with certain limitations. These providers are instrumental in driving the adoption and usage of semi-closed wallets, and their prominence reflects the evolving nature of digital payment solutions in the country. Understanding the landscape of prominent providers is critical for users and stakeholders to make informed decisions regarding their digital payment preferences and strategies.

Analyzing Open System Payment Wallets

Versatility of open wallets

Open system payment wallets, also known as open wallets, offer a versatile approach to financial transactions, allowing users to load money from various sources such as net banking, cards, and UPI. These open wallets operate similarly to bank accounts, with the added flexibility of being able to be operated by banks, while still being subject to the same norms and compliance levels as semi-closed loop wallets. This versatility makes open wallets like PayTM a popular choice for users, as it provides the convenience of a digital wallet with the accessibility of a traditional bank account.

ATM withdrawals and banking services integration

One key feature of open system payment wallets is the integration of ATM withdrawals and banking services, allowing users to top up their wallets with cash from their bank accounts, transfer funds back to their bank accounts, and make purchases from merchants. However, unlike closed loop wallets, ATM withdrawals are not allowed with open wallets, making them a more flexible and secure option for users looking for a digital payment solution that still offers the ability to access banking services.

Examples and acceptance of open system payments

Examples and acceptance of open system payments, such as PayTM and DBS Internet bank account, demonstrate the widespread adoption and popularity of these open wallets. These wallets provide users with the ability to load money from various sources, operate similarly to bank accounts, and offer the convenience of digital payments, making them a preferred choice for individuals and businesses alike. The acceptance and usage of open system payment wallets continue to grow, as they provide a secure and versatile solution for financial transactions.

The Compliance Aspect of Digital Wallet Operations

Security measures and consumer protection

Ensuring the security of digital wallets and protecting consumers is a top priority in the operation of these financial tools. Security measures such as encryption, multi-factor authentication, and secure data storage are implemented to safeguard against unauthorized access and fraud. Additionally, consumer protection policies are put in place to address issues such as unauthorized transactions, fraud, and dispute resolution, providing users with confidence in the safety of their digital transactions.

The process of obtaining RBI permission for wallets

Obtaining permission from the Reserve Bank of India (RBI) for digital wallets involves a comprehensive process. This includes the formation of the company, submission of necessary documents, and meeting specific eligibility criteria set by the RBI. Entities seeking permission must adhere to the guidelines and rules outlined by the RBI for different types of payment wallets, such as closed system, semi-closed, and open system wallets. Meeting these requirements is crucial in obtaining the necessary approval to operate as a digital wallet provider in India.

Regular monitoring and the role of KYC

Regular monitoring and the implementation of Know Your Customer (KYC) processes play a vital role in ensuring compliance with regulatory standards. By conducting regular audits and checks, digital wallet providers can identify and address any potential security or compliance issues. Additionally, the KYC process helps in verifying the identities of users, mitigating the risk of fraudulent activities, and ensuring adherence to anti-money laundering regulations.

The Future of Digital Wallets in India’s Financial Ecosystem

Innovations and Technological Advancements in Wallet Services

The digital wallet landscape in India has been marked by continuous innovations and technological advancements, leading to the introduction of various types of payment wallet licenses. These advancements have facilitated the seamless integration of digital wallets into the financial ecosystem, offering users a convenient and efficient means of conducting financial transactions. The proliferation of mobile technology and the widespread availability of internet services have further catalyzed the evolution of digital wallets, enabling users to access their funds and make payments with unparalleled ease.

One key innovation in wallet services is the introduction of closed system payment, semi-closed payment, and open system payment wallets, each catering to specific use cases and functionalities. The diverse range of wallet services has expanded the scope of financial inclusion in India, providing individuals and businesses with access to secure and user-friendly digital payment solutions.

Impact of Digital Wallets on Traditional Banking

The advent of digital wallets has significantly impacted traditional banking practices in India. The convenience and accessibility offered by digital wallets have led to a shift in consumer behavior, with an increasing number of individuals and businesses opting for digital payment solutions over traditional banking services. This shift has compelled banks to enhance their digital offerings and adopt a more customer-centric approach to remain competitive in the evolving financial landscape.

Moreover, digital wallets have accelerated the pace of financial transactions, enabling users to conduct seamless and instantaneous payments, thereby reducing their reliance on traditional banking channels. This transformation has prompted traditional banks to reevaluate their service offerings and explore innovative ways to integrate digital wallets into their existing infrastructure, ensuring continued relevance in the digital era.

Predictions for Digital Wallet Adoption and Usage Trends

As digital wallet adoption continues to gain momentum in India, several trends are anticipated to shape the future landscape of financial transactions. The increasing penetration of smartphones and internet connectivity is expected to drive significant growth in digital wallet adoption, particularly among the unbanked and underbanked segments of the population. This trend is poised to redefine the dynamics of financial inclusion, empowering individuals and businesses with access to secure and efficient payment solutions.

Furthermore, the integration of advanced technologies such as biometric authentication, artificial intelligence, and blockchain in digital wallets is likely to enhance security and user experience, further fueling their adoption across various sectors. The rise of digital payment platforms and the emergence of innovative use cases for digital wallets are also expected to contribute to a surge in their usage, making them an integral part of India’s evolving financial ecosystem.

conclusion

In conclusion, the regulatory framework for digital wallets in India is overseen by the Reserve Bank of India (RBI), which plays a significant role in ensuring adherence to established norms and compliance levels. The types of digital wallets in India, categorized as closed system, semi-closed system, and open system payment wallets, each offer their own advantages and limitations. Understanding how semi-closed wallets function and the versatility of open wallets is crucial for users and providers alike. Additionally, ensuring the security of digital wallets and protecting consumers is a top priority, with the KYC process helping to mitigate the risk of fraudulent activities. The continuous innovations and technological advancements in the digital wallet landscape have prompted traditional banks to reevaluate their service offerings, ensuring continued relevance in the digital era. With the RBI overseeing and regulating digital wallets in India, the future of digital wallets in the country’s financial ecosystem looks promising, offering convenience and security for users and businesses alike.